SharedStake: Best Opportunity in DeFi

Double the Rewards, Half the Fees & Hearty ETH 2.0 Staking

Edit: SharedStake has since suffered a rug. The author no longer supports this project. Exercise caution with all your investments in DeFi.

SharedStake is a decentralized Ethereum 2 staking solution that allows users to stake any amount of Ether and earn additional yield on top of their ETH2 rewards.

Compared to the leading ETH2 staking service on the market today, SharedStake offers users Double the Rewards and Half the Fees.

This makes SharedStake the Most Lucrative Ethereum 2 Staking Service in DeFi.

Discovering SharedStake

When I originally discovered SharedStake, it appeared like a diamond in the rough. Like a new restaurant with no Yelp reviews, I felt a sense of hesitation when I first gave them a try. However, their Certik audit gave me a sense of security. Additionally, Cryptopher Robin and I had interviewed founder Chimera for the first episode of our new podcast DeFi Expectations. We loved what we heard and began staking ETH on their platform days after.

What marveled me the most about SharedStake is how relatively unknown the project is to the greater DeFi community in spite of several benefits when compared to the rest of the competition. Having their Twitter page frequently suspended, without reason from Twitter support, hasn’t exactly helped their visibility. Yet, the project continues to offer competitive yield for its growing community, and the SharedStake team remains engaged with their user base through their Discord server and community forum.

Shortly after staking with SharedStake, I decided to take an active role in marketing at SharedStake. Does this mean I’m biased? Of course. But like my previous work with Badger DAO, I came here based on passion and belief in the core product.

SharedStake; Objectively Better

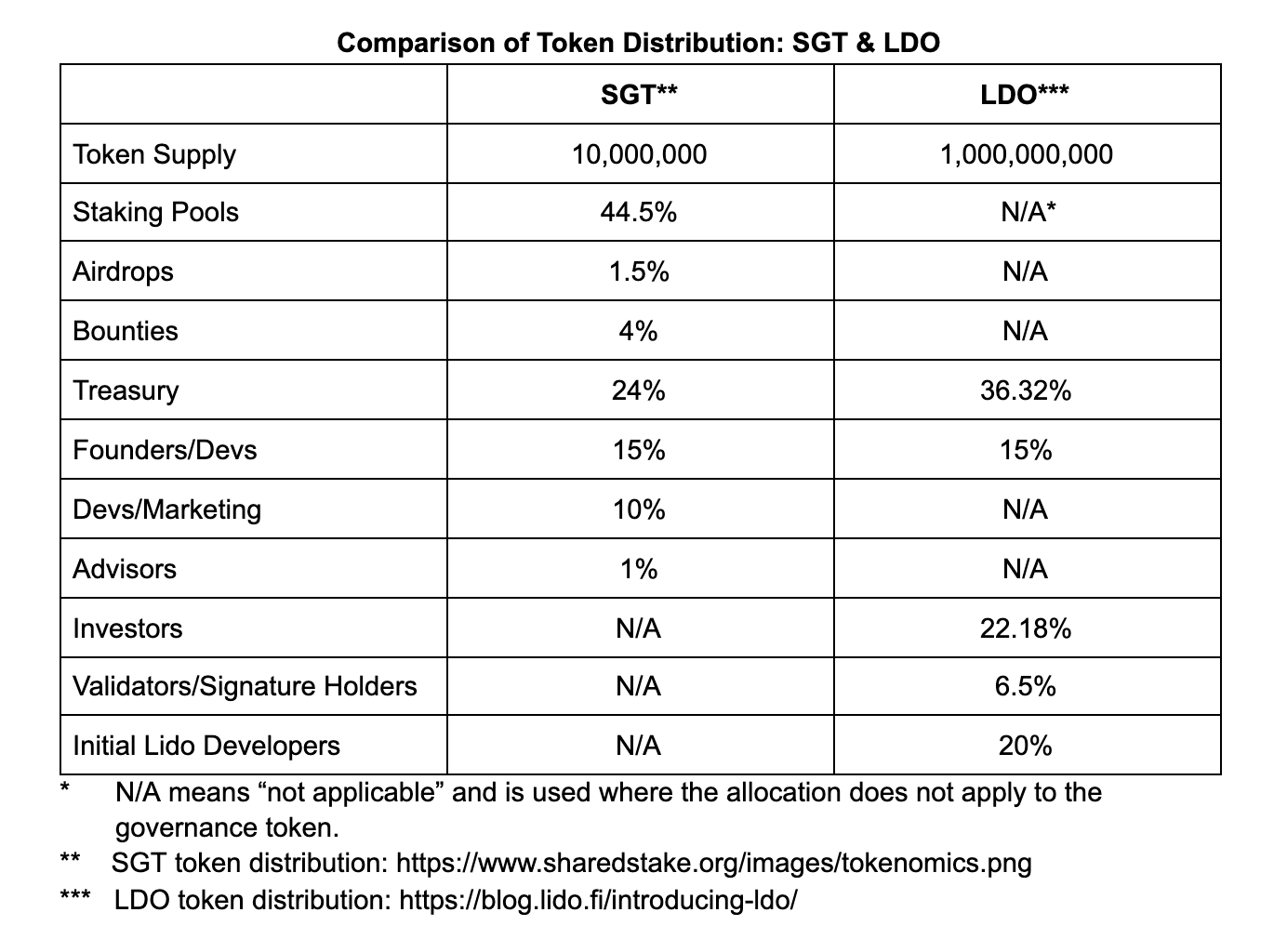

Admittedly, it’s hard to be objective about a project you have financial commitments with. But if you knew nothing else about either of the DeFi protocols in the chart below, would it still be obvious which one offered a better ROI?

This chart comes from a comparison piece written on SharedStake vs Lido Finance. As you can see from the chart above, there is a clear difference in the fees retained by both protocols as well as the rewards generated through use. The rest of the chart gives you greater insight as well into their corresponding tokenomics.

Opportunity; Tremendous Potential Upside

The most obvious sign of potential future price movement, aside from previous ATHs (all-time-highs), is the current market cap / TVL (total-value-locked) ratio. This current ratio of ~5% comes from numbers provided via Dune Analytics.

Typically, projects with a high market cap to TVL ratio are considered overvalued, whereas projects with a low market cap to TVL ratio are considered undervalued. With a market cap so low relative to the total value locked in the protocol, around $40.6 million at the time of this snapshot, $SGT has potentially massive upside.

This potential upside is further supported by improvements coming to the protocol through community governance and developer action. Currently, vETH2 can be used as collateral on Ruler Protocol, another DeFi project from the same team that developed Cover Protocol. In the near future, users will be able to insure the deposits they make through Cover Protocol as well. A dashboard is presently being built by SharedStake developer Ice Bear to provide additional analytics on the rewards generated through using the platform. Another example is veSGT, a page out of Curve Finance’s book, where vested SGT over a period of time translates to boosted rewards. Users are able to lock SGT for a period of time in exchange for boosted protocol rewards, effectively reducing sell pressure on their native governance token SGT, whilst providing additional utility for holders.

When I first wrote about SharedStake, I compared them to Badger DAO. SharedStake represents a mastery of Ethereum 2.0 staking akin to what Badger represents for bringing Bitcoin to DeFi. If you’re an ETH maximalist, I don’t really have to explain to you what that means. However, as Ethereum continues to perform strongly against BTC, DeFi enthusiasts are faced with an increasingly relevant question:

Where is the best place in DeFi to earn rewards on staked Ethereum?

Based on what I’ve seen from this project and what I plan to bring to the table as part of their marketing team, I believe SharedStake is the answer.

SharedStake:

https://www.sharedstake.org/

Do your own research. Not financial advice. Make responsible decisions and be the future you want to see in DeFi.

-DeFi Fry